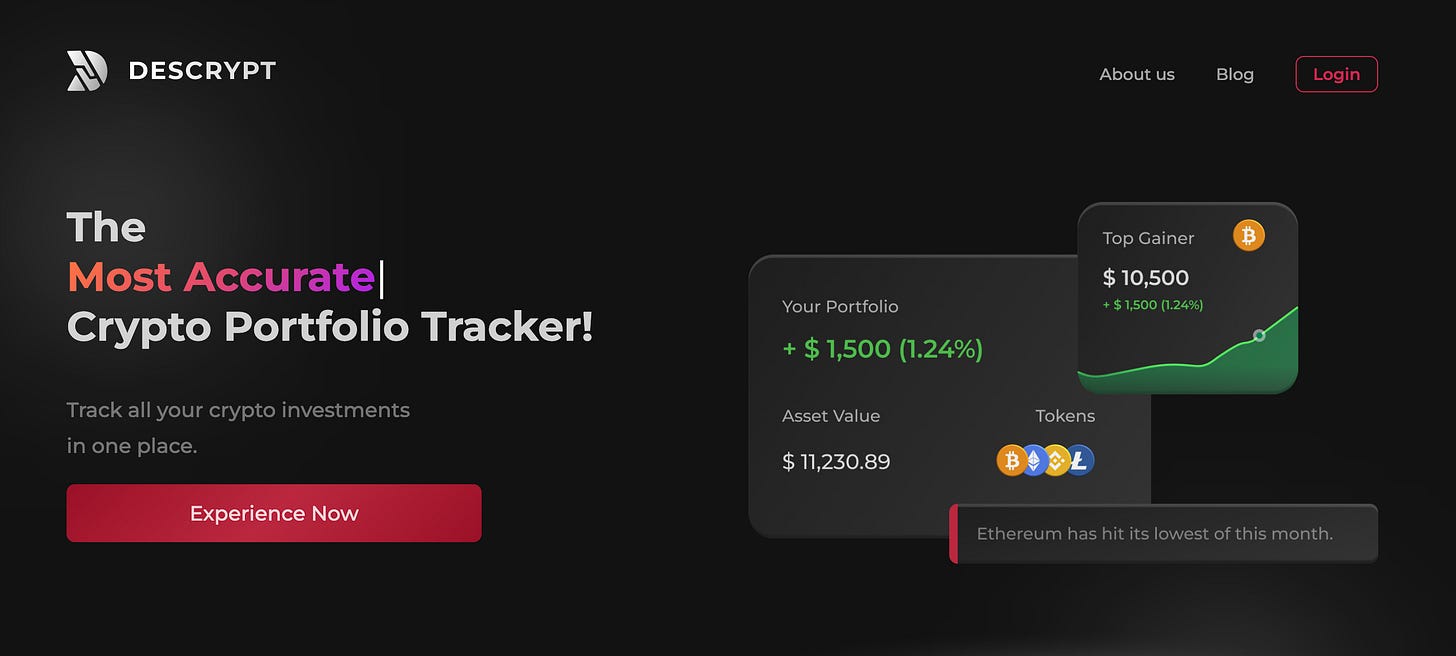

Descrypt: crypto portfolio tracking made easy

Thoughts on potential product features and monetization plays

In the crypto world, there are many different ways you can hold your tokens. One can hold them on a centralized exchange like Binance, Kraken, or CoinDCX or hold tokens on-chain with a Metamask or Phantom wallet. It is also possible to hold tokens on a hard wallet like Ledger and Trezor.

It is very common for crypto native people to hold assets on multiple centralized exchanges (CEX) and on-chain as well; different tokens have different levels of liquidity on different CEXs and keeping tokens on-chain is a form of self custody, it eliminates chances of losses due to exchange illiquidity as seen in the FTX fiasco.

However, the challenge is that tracking tokens in different places becomes a fragmented experience. Most retail investors and even big trading desks/VCs end up using excel to track their holdings.

Descrypt is a crypto portfolio management tool that allows users to get an API-enabled aggregated view of their crypto holdings from different exchanges in one place.

For those who are not familiar with crypto, think about it as yahoo finance’s portfolio tracker but the platform also allows you to link Zerodha, HDFC securities, xyz any exchange, etc together and track all your holdings in one place seamlessly.

The monetization roadmap ahead for Descrypt is to help US citizens file taxes on their crypto holdings. Filing tax is genuinely a user pain point in the industry, how do you file tax for 5x pump gains and justify token holdings that have gone down 90% and don't have the liquidity to sell and book losses.

An additional monetization roadmap could be to help users understand how much of their portfolio is essentially “dry powder”; help users gauge which of their token holdings can earn yield. Integrating yield generation through third parties into the platform and charging yield gain percentages to the user could act as a constant source of revenue for Descrypt.

The third-party yield aggregators could also be charged instead of the user; these yield-generating models are usually some form of lending/borrowing platforms and always struggle with liquidity.

In terms of other potential product features, a portfolio management tool would add value to users if it enabled webhook integration into telegram, slack, etc. Allow users to get custom telegram-delivered message notifications at custom times about custom tokens on custom exchanges.

People love sharing their gains; adding a line at the end of the webhook notification saying “aggregated on Descrypt” will go a long way when the message is forwarded by the user on telegram, slack, etc.

Zapper.fi is a portfolio tracker too but only for on-chain tokens; I love zapper.fi’s UI and their community-style platform. Descrypt should definitely consider progressing towards a similar community-style platform where users can search the CEX + on-chain holdings of other users.

Another interesting feature would be to help users holding governance tokens get notified about upcoming proposal votes and promote engagement.

From the enterprise B2B lens, some web3 VCs have started actively investing in public markets after the post-FTX slowdown of private markets. A portfolio tracker helps them track everything in one place but they already must have processes (on excel xyz) in place to do this and might be adamant to change.

It's important to understand what the excel portfolio tracker can't do; it can’t notify. The webhook feature is golden for these VCs as it enables instant notifications.

Additionally, VCs also want to understand and visualize token unlock schedules of their investments; maybe the B2B version could help VCs track vesting and token unlocks similar to VTVL.

It’s a similar story for trading desks in terms of tracking PnL on excel; the webhook notification angle is much needed here too. Trading desks take it one step further, where they have multiple desks, implementing different strategies on many exchanges (based on liquidity). The trading desk B2B model needs to help these desks track each desk, each strategy, and each exchange separately and help upper management track performance.

I love the daily portfolio PnL emails that I get from Descrypt; the founding team members are all chads, looking forward to how they build this tool ahead!